The trustee of the distribution trust for Metaldyne Corporation n/k/a Oldco M Corporation (Bankruptcy Court Southern District of New York) has sent out over 500 demand letters for recovery of bankruptcy preferences. With the statute of limitations for bringing of preference actions expiring on May 27, 2011, the negotiation stage of the claim resolution process will be intensifying. The trustee, Executive Sounding Board Associates Inc. (the “Trustee”) has reported that, as of mid January, the Trustee had collected over $391,000 in preference recoveries and reduced the unsecured creditor class by over $1.38 million. Duane Morris LLP (New York, New York) has been retained to prosecute avoidance actions. Larry J. Kotler is lead attorney for Duane Morris in the bankruptcy preference recovery campaign. Pryor Cashman, LLP has been retained to prosecute avoidance actions as to which Duane Morris has a conflict.

Articles tagged with: automotive suppliers

Checker Motors Corporation Creditors Committee to Jump Start Bankruptcy Preference Recovery

On December 29, 2010, with only 2 weeks left before expiration of the statute of limitations for bringing preference actions, the Creditors Committee in the Checker Motors Corporation bankruptcy (Bankruptcy Court for the Western District of Michigan Case No.: 09-00358) moved for authority to file preferential transfer recovery actions (the “Standing Motion”) in anticipation of the approval of the proposed Plan of Liquidation. The Plan of Liquidation contemplates that all remaining assets of the Debtor, including avoidance actions under Chapter 5 of the Bankruptcy Code, will be assigned to a Liquidating Trust. With no filed opposition to the creditors committee’s motion, there is no reason to expect that the requested authority will not be granted.

Pretty Products, LLC Bankruptcy – Background, Petition Statistical Information, Initial Direction and 20 Largest Unsecured Bankruptcy Creditors

Pretty Products, LLC (“Pretty Products” or the “Debtor”) filed a petition on June 15, 2010 in the Bankruptcy Court for the Northern District of Georgia (case number 10-12286) for relief under Chapter 11 of Title 11 of the United States Code. The case has been assigned to Judge W. Homer Drake.

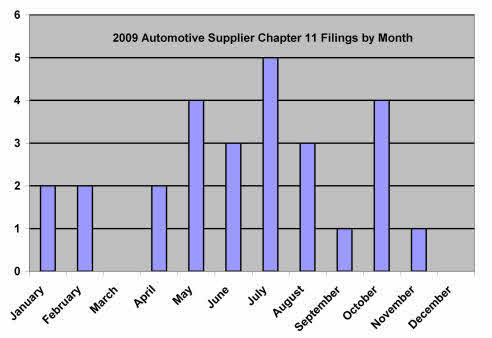

27 Automotive Suppliers File Chapter 11 Bankruptcies in 2009; End of Year Status Summary; Likelihood of Bankruptcy Preference Recovery

Pressures in the global automotive industry forced 27 FN1 automotive parts and component manufacturers and 2 automakers t o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

This article provides a comprehensive list of the 27 automotive supplier Chapter 11 bankruptcies in 2009, together with status at the end of 2009, estimated trade creditor recoveries and the potential for avoidance actions.

Recticel Interiors Bankruptcy – Background, Petition Information and Assessment of Direction

Recticel North America, Inc. (“Recticel NA”) and its subsidiary, Recticel Interiors North America, LLC (“Recticel Interiors”), filed bankruptcy on October 29, 2009 with the express aim of terminating the automotive parts supply contracts with its two largest customers – Johnson Controls, Inc. and Inteva Products, LLC. According to the debtors’ affidavit filed with the petitions, due to pricing issues, the supply contracts with these two customers alone had caused the debtors’ to incur “losses, on average, of approximately $600,000 per month on account of the Johnson Agreement and approximately $265,000 per month on account of the Inteva Agreement… .”

The following post provides basic identifying information about the bankruptcy, summarizes the debtors’ business, describes the debtors’ corporate structure, and gives a brief initial assessment of the direction of the bankruptcy.

FormTech Industries – 30 Largest Unsecured Bankruptcy Creditors

FormTech Industries, LLC. (“FormTech”) together with its parent, FormTech Industries Holdings, LLC (collectively “Debtors”) filed petitions on August 26, 2009 in Bankruptcy Court for the Delaware for relief under Chapter 11 of Title 11 of the United States Code (Case Nos. 09-12964 and 09-12965, respectively). FormTech is a leading manufacturer of precision hot forgings for sale to automotive equipment manufacturers and Tier 1 automotive suppliers. The filing represents the continued ravaging of the ranks of suppliers serving the automotive industries. Due to the large lead times for re-validation of new suppliers, close attention from the FormTech customers can be expected.

FormTech has requested authority to file a consolidated list of the 30 largest unsecured creditors (the “Top Unsecured Creditor List”) in lieu of a separate list for each of the Debtors. The list is heavily populated with raw material suppliers and automotive supplier subcontractors. The complete list is provided below.

Cooper-Standard Automotive Combo 503(b)(9) Claims, Essential Supplier and Foreign Vendor Motion

Cooper-Standard Holdings Inc. and its affiliated debtors (“Cooper-Standard Automotive” or the “Debtors”) have combined into one motion a request to allow payment of 503(b)(9) administrative expense claims, a request to allow payment of critical vendors a/k/a essential suppliers, and a request to allow for payment of foreign vendors. The dollar amount of pre-petition claims Cooper-Standard Automotive is seeking to pay seems to vary between the motion and the interim and final orders. However, the relief requested in the interim order is for authority “to pay, in their sole discretion, as and when they come due, Essential [including 503(b)(9)] and Foreign Suppliers Claims in an amount that shall not exceed $19.5 million.”

Cooper-Standard – 30 Largest Unsecured Bankruptcy Creditors

Cooper-Standard Holdings Inc., (“Cooper-Standard Holdings”) has requested authority to file a consolidated list of the 30 largest unsecured creditors of Cooper-Standard Holdings and its affiliated Debtors (the “Top Unsecured Creditor List”) in lieu of a separate list for each of the Debtors. As could be expected, the Top Unsecured Creditor List is heavily populated with automotive suppliers.

Cooper-Standard Automotive Bankruptcy – Debtors and Petitions

Cooper-Standard Holdings Inc. and 12 affiliated entities (”Debtors”) filed a petitions in Bankruptcy Court for the District of Delaware for relief under chapter 11 of title 11 of the United States Code. The Debtors are a leading global automotive manufacturer of fluid handling, body sealing, and noise, vibration and harshness control components, systems, subsystems, and modules, primarily for use in passenger vehicles and light trucks for global original equipment manufacturers and replacement markets.

Stant Corporation – Largest Unsecured Bankruptcy Creditors

Stant Parent Corp, as lead debtor, and its 5 affiliated Debtors (“Debtors”) have requested authority to file a consolidated list of the 20 largest unsecured creditors for itself (the “Top Unsecured Creditor List”) in lieu of a separate list for each of the Debtors. While the trade debt numbers on the Top Unsecured Creditor List are substantial, trade debt claims are small compared to unsecured debt (including preferred stock) and accrued interest and dividend claims.

See the Stant Corporation <a title=”DOCSHEETS™ – BANKRUPTCY CASES” href=”http://www.burbageweddell.com/docsheets-bankruptcy-cases/”>Docsheet™ Report</a> for subsequent <a title=”Stant Corporation Bankruptcy” href=”http://www.burbageweddell.com/docsheets-bankruptcy-cases/stant-docsheet/”>selected docket entries in the Stant Corporation bankruptcy proceedings</a>.