There are numerous “defenses” to a bankruptcy preference claim. The 3 most common defenses are:

the ordinary course of business defense, (which is described in this article)

the contemporanous exchange defense (which you can see by clicking this link); and

the subsequent new value defense (which you can see by clicking this link).

As discussed in detail below, the ordinary course of business defense can be a very difficult defense to prove and require extensive use of the debtors books and records covering a potentially extended period. The defense is also one of the very best in the resolution negotiation process and well worth the effort required to assert it. The very reason it is difficult to prove makes it difficult for the bankruptcy preference claimant to defeat.

The Elements of the Ordinary Course of Business Defense

The ordinary course of business defense has 2 requirements:

(1) that the obligation being paid was incurred in the ordinary course of business or financial affairs of the customer and the supplier;

AND

(2) that eitherFN1

(A) the payment have been made in the ordinary course of business of both the supplier and the customer;

OR

(B) the payment was made under “ordinary business terms.”

For suppliers of goods and services, the requirement that the customer incurred the debt in the ordinary course most often is undisputed. The inquiry is resolved when it is shown that the goods or services supplied were used in the normal operations of the debtor.

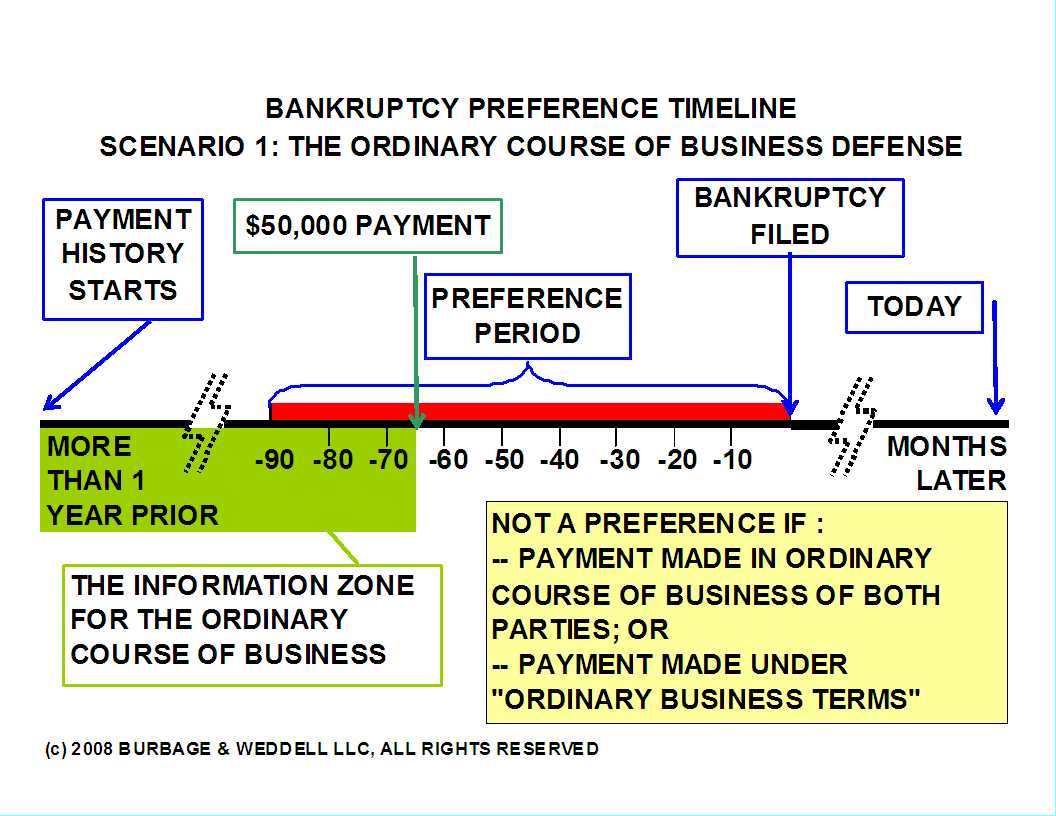

The following slide provides an overview of the second requirement of the defense.

This article focuses only on the first leg i.e. that the payment has been made in the ordinary course of business. The second, “ordinary business terms” leg, is an”industry standards” test and almost always requires the hiring of an expert to provide testimony of what constitutes “ordinary business terms.”

Payment in the Ordinary Course of Business

The “payment in the ordinary course of business test” is a relationship test. Some courts have referred to this test as a “subjective” test. In other words, the court is going to have substantial leeway in determining if the test has been met.

Courts can consider any number of factors. However, the factor considered first in most cases is the timing of payment. We address this factor in more detail below.

The other factors that seem to get the most attention are the following:

(1) whether the amount or manner of payment (e.g. check became wire) differed from past practices;

(2) whether the debtor or the creditor engaged in any unusual collection or payment activity; and

(3) whether the creditor took advantage of the debtor’s deteriorating financial condition.

The second point brings into play any communications threatening to cut off supply if payment is not made. If the debtor is able to produce these types of communications, the ordinary course of business defense can be even more difficult to prove.

The third point usually will bring into focus whether the supplier changed any terms to “compensate” the supplier for the increased “payment risk” the supplier perceived.

The Timing of Payments

A critical factor in establishing that payments were made in the ordinary course of business is establishing that the timing of the payments did not vary from the “ordinary” or “normal” dealings between the parties.

The analysis and presentation on this issue can get very complex and requires a multi-disciplined approach. The simplistic approach of counting days from invoice date can yield results that appear to show significance variance in the timing of payments. However, batching of invoicing, factors that might delay processing of invoices for payment and other extraneous factors all have to be taken into account. Where there are numerous payments, a statistical analysis of mean and median values both including and disregarding outliers may present a more accurate and favorable picture.

Presentation is extremely significant as well. Providing spreadsheets and charts to illustrate the sophistication and thoroughness of the analysis has the potential to substantially improve the negotiation posture.

The bottom line is that this is another area where the skill and abilities of bankruptcy preference counsel can really shine through and make a major difference.

The Look Back Period for Establishing the Defense

The period of time during which your books and records are going to apply to this defense (the “zone of information”) extends from the date of the payment back in time for an indefinite period but the bear minimum is at least 1 year.

There are cases where the court looked back more than 3 years. Simply, the court will require the supplier to go far enough back to establish a “baseline” of dealings fixed at least in part when the debtor’s day-to-day operations were “ordinary” or “normal”. The key is being able to establish a period when the debtor was not in financial distress and having enough transactions during the period to prove the manner in which payment would “normally” be made. For this reason, of all the defenses, the ordinary course of business defense is the most demanding in terms of the books and records the supplier is required to produce.

A Video Review of a Simple Scenario

[stream base=x:/www.burbageweddell.com/wp-content/uploads/videos flv=BP_Basics_Part_3_OCB.flv img=BP_Basics_Part_3_OCB.JPG mp4=BP_Basics_Part_3_OCB.mp4 embed=false share=false width=540 height=405 dock=true controlbar=over bandwidth=high autostart=false /]

In the above video, we review the basics of the ordinary course of business defense. The video addresses only a simple scenario where there is a single payment in the Preference Period. However, many suppliers of goods and services will invoice on shipment and will make multiple product shipments to a customer. The customer in turn will “batch” these invoices. Working with these types of multiple invoice/multiple payment situations is where a suppliers bankruptcy preference counsel can bring his or her expertise to bear and potentially defeat big chunks of a preference claim. These are situations where no video can convey the potential complexities of the ordinary course of business defense.

The video does provide a good discussion of the basis concepts of this defense. These concepts will hold true even if their practical application can get very complex.

In defending preference claims, you may see that the customer’s bankruptcy representative says it has considered the defense. However, even slight changes in methodology for this analysis can cause a dramatic effect in terms of the supplier’s preference exposure. Experienced bankruptcy preference counsel will push for application of the most favorable methodology for the supplier.