From the perspective of the preference claimant1 , the identification of a bankruptcy preference payment follows a fixed routine. The starting point is simply an identification of payments that cleared the debtor’s bank account during a period starting on the 90th day prior to the bankruptcy filing. Depending upon what information is available to the preference claimant, it may work with the debtor’s bank account statements, the accounting records of the debtor (especially the cash disbursement journals) or simply the debtor’s schedule of financial affairs filed in the bankruptcy case. This will show the preference claimant the universe of possible preference claims.

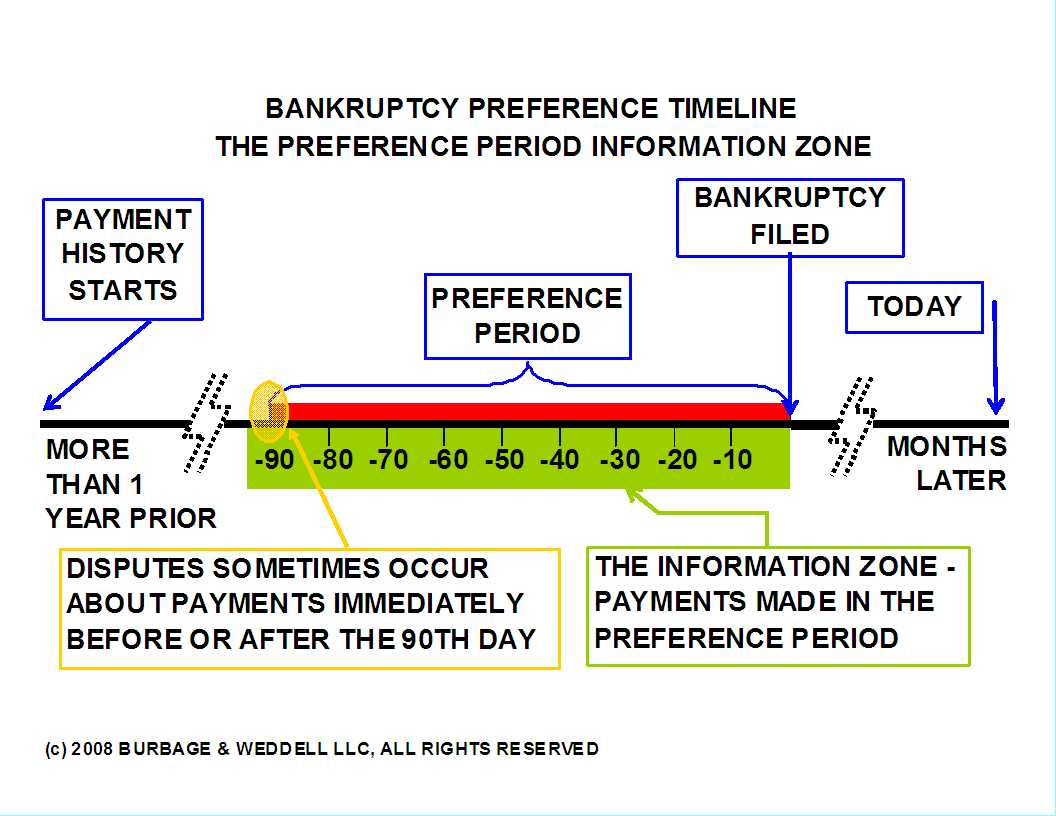

The slide below shows a basic time line for identifying a bankruptcy preference payment. You can click on the slide to see it in full page. The portion in green is the “information zone“. The information zone is a phrase coined by us to describe the period during which the facts were established that should resolve the issue being considered. In this case, the green highlights the information zone for the identification of a payment that may be found to be a bankruptcy preference payment.

How to Count 90 Days

By definition, a preferential transfer in bankruptcy is any transfer “on or within 90 days before the date of the filing of the petition.”

Bankruptcy courts generally hold that Federal Rule of Bankruptcy Procedure 9006(a) applies in making this calculation. That rule simply says that, in counting any period, you exclude the date of the triggering event and include the last day. The event identified in Section 547(b) is the date of the filing of the petition. Under Rule 9006(a), to count the 90 day preference period, start counting 90 days backward from and including the day before the date the petition was filed. (Note that payments on the petition date are covered as potential preferential payments by the “on … the date of filing the petition” language in Section 547(b)(4)(A).)

Neither the bankruptcy courts nor bankruptcy preference plaintiffs have been consistent in determining the preference period. First, among the courts, for a long time there was disagreement as to whether to count forward from the transfer date or backward from the petition date. This forward versus backward counting issue arose because Federal Rule of Bankruptcy Procedure 9006(a) says that if the last day of the period being counted is a weekend or holiday you go to the next business day. That issue seems now to be pretty well resolved, and the courts have consistently held that the preference period is not extended if the 90th day falls on a weekend or holiday.

Despite the demise of the forward versus backward counting controversy, there remains a substantial area of potential disagreement in calculating the 90 day period. The potential for argument is allowed by the phrase “within 90 days before” phrase in Section 547(b)(4)(A). Simply, does “within” mean “after” the 90th day (counting backwards) and before the petition date?

There are no decisions that expressly address this question. However, the controversy does play out on a practical level. A recent mass preference action in Delaware defined the preference period as being from December 10, 2008 to and including the petition date of March 9, 2009. This would make the preference period 89 days plus the petition date making a total of 90 days. Compare the preference period calculation method used in the 1700 Quebecor World (USA) bankruptcy preference actions in New York. In those adversary proceedings, the preference period was October 23, 2007 to and including the petition date of January 21, 2008. This is a period of 90 days prior to the petition date plus the petition date, for a total of 91 days.

The bottom line is that if a payment is made on the 91st, 90th or 89th days prior to the bankruptcy petition filing date (using whatever calculation method), the issue deserves close attention by bankruptcy preference counsel.

The Broad Concept of a Transfer

A “transfer” is anything of value, whether or not tangible, that the bankrupt customer gave any creditor or gave up for the benefit of a creditor for any reason.A payment is just one type of transfer.There are many types of transfers.For example, if the customer gives a supplier a security interest in its inventory (even inventory originally provided by the supplier), the giving of that security interest is a transfer.Also, if during the bankruptcy preference period bankrupt customer returns to a supplier goods that it can not pay for, that return is a transfer.

The debtor’s claim representative can, and in all likelihood will, review the debtor’s vendor ledger during the preference period and, if there is an unexplained reduction in accounts payable, make further inquiry to determine the cause why. Other types of preferential transfers inevitably turn up just in the ordinary course of a bankruptcy. A classic example is where a supplier, immediately prior to the customer’s bankruptcy filing, is allowed by the customer to “repossess” raw material inventory previously delivered to the customer.

Sometimes a preferential transfer escapes identification and the debtor’s claim representative brings a preference claim based only on payments made during the preference period. In this event, the potential preferential transfer claim represents a latent preference liability for the supplier. It is imperative for a supplier to tell its counsel (and counsel always should ask) whether the is any preferential transfer exposure before deciding on a course of action in negotiating a threatened bankruptcy claim.

[stream base=x:/www.burbageweddell.com/wp-content/uploads/videos flv=BP_Basics_Part_1_The_Payment.flv img=BP_Basics_Part_1_The_Payment.JPG mp4=BP_Basics_Part_1_The_Payment.mp4 embed=false share=false width=540 height=405 dock=true controlbar=over bandwidth=high autostart=false /]

A bad scenario can develop were a previously overlooked preferential transfer is discovered by the debtor’s claim representative during the prosecution of a preference claim. Hypothetically, the lawyer who thinks he is defending a preference claim based on payments totalling $50,000 might suddenly find that the exposure just increased to $150,000.

In the above video, we discuss the identification of preference payments, the information zone regarding these payments and the application of these concepts to a simple example.

________________

1 The bankruptcy preference claimant may be the debtor in possession, creditors committee, plan representative (in the case of a reorganization) or a Chapter 7 trustee (in the case of a liquidation) or other transferee of the debtor’s avoidance actions (in the case the debtor’s preference claims have been assigned pursuant to Bankruptcy Court Order.