Over a 3 day period, August 9th, 10th and 11th, 2010, the trustee of the liquidating trust for Intermet Corporation and its 19 co-debtors (the “Debtors”), filed 204 (almost immediately reduced by 3 to 201[fn1]) bankruptcy preference actions. The adversary proceedings are pending before Judge Kevin Gross. An analysis of the complaints shows:

- a sharply inverse proportion of the size of potential preference recoveries to the number of defendants from whom such recoveries are sought;

- the continued challenges for small bankruptcy preference claim defendants in challenging venue based on the claim threshold requirement of 28 USC Section 1409(b); and

- the challenges of bankruptcy preference defense counsel in multi-debtor bankruptcies in assessing and asserting the venue defense.

So Little Potential Preference Recovery from So Many

The bankruptcy preference defendant profile in Intermet is not uncommon in the manufacturing sector. The spreading out of a manufacturer’s supply base among a large number of suppliers commonly means that, when it comes time for preference recovery, the vast majority of defendants provide a relatively small preferential transfer recovery opportunity for the estate.

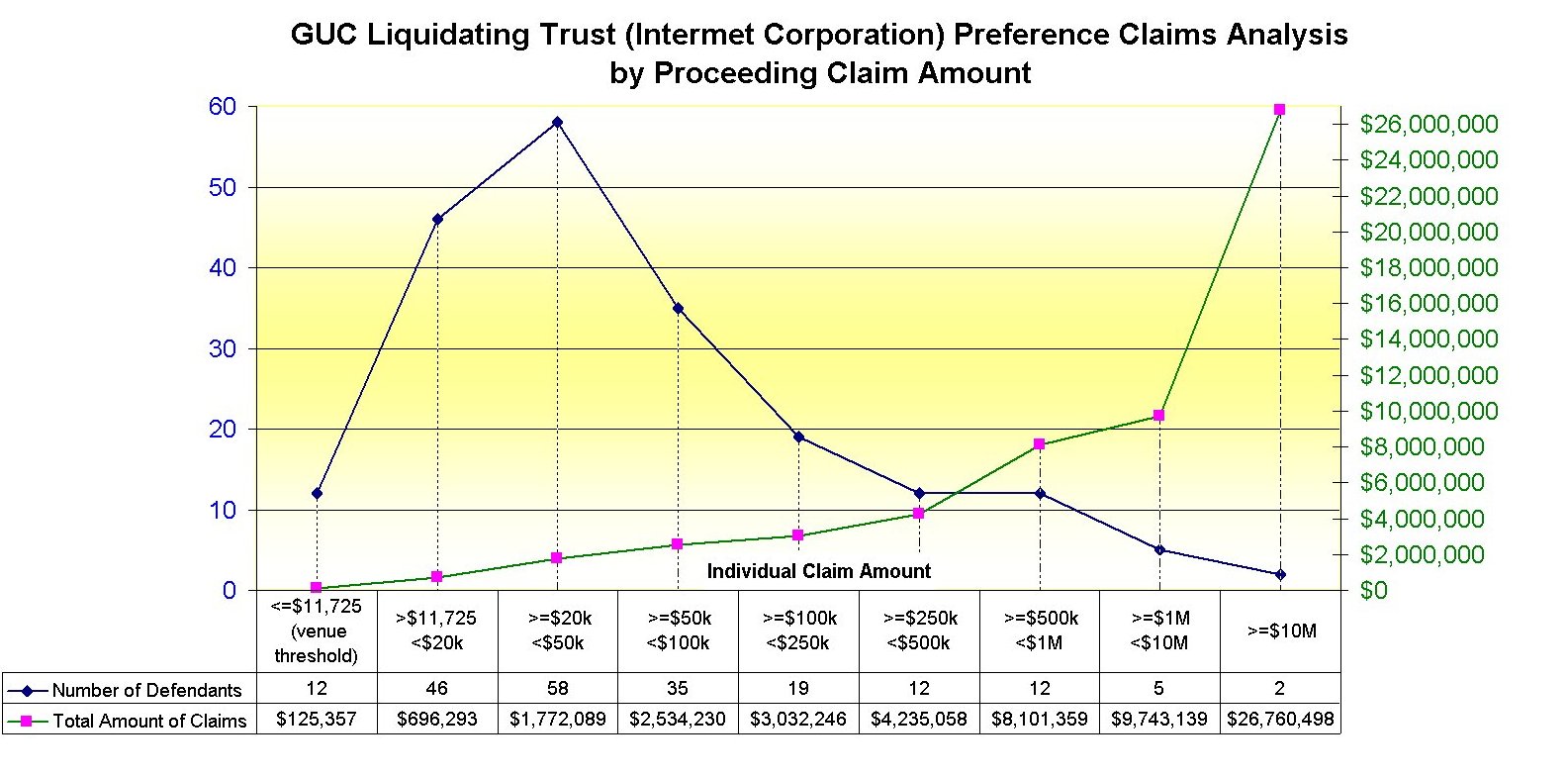

In Intermet, more than 75% of the defendants (152 out of the 201) have the potential to produce less than 10% of the recovery amount ($5,127,969 of a total of $57,000,268). This situation is illustrated in the following chart (to see the chart in full screen click this link):

More than half of the defendants by number (116) are being subjected to preference claims of less than $50,000. These claims, in the aggregate, have the potential to produce less than 4.5 percent ($2.6 million of the total of $57 million) in preferential transfer recoveries.

For a preference defendant facing a preferential transfer claim of less than $50,000, the focus must be on total costs of resolution – settlement payment plus defense costs. Rapid assessment and clear and persuasive presentation of defenses is key to a positive resolution after adding together settlement payment and the costs incurred in reaching the settlement.

The pursuit of small preference claims by debtors and trustees is not going to stop anytime soon. Even if the recoveries are proportionally small to the total recoveries, small claim collections provide a source of initial funding of the overall bankruptcy preference recovery effort. Simply, in many cases, the early small claim preference recoveries fund the expenses of prosecution of larger preference claims.

Delaware Bankruptcy Court Venue in Claims Less than $11,725 – Is the Section 1409 Dollar Amount Venue Requirement Practically Meaningless?

After the May 10, 2010 decision of Judge Gross, in Dynamerica Mfg. LLC v. Johnson Oil Co., LLC, 2010 WL 1930269 (Bkrtcy.D.Del., May 10, 2010), it was hoped that Delaware Bankruptcy Courts would no longer see bankruptcy preference actions below the $11,725 venue threshold requirement of 28 USC Section 1409(b). See “Delaware Bankruptcy Court Confirms Applicability of Section 1409(b) Venue Dollar Threshold to Claims for Recovery of Avoidable Preferential Transfers under Section 547“.

In Dynamerica, Judge Gross noted that:

In 2005, Congress enacted the Bankruptcy Abuse Prevention and Consumer Act of 2005 (“BAPCPA”). Among the many changes Congress made was the amendment to 28 U.S.C. § 1409(b). Section 1409(b), as amended, gives substantially greater protection to creditor defendants by making noninsider defendants on non-consumer debts subject to suit where they reside if the debt is less than $10,000 (which has since been amended to $10,950 [now 11,725]). Charles J. Tabb, The Brave New World of Bankruptcy Preferences, 13 ABI L. REV. 425, 428, 437-39 (2005).

The 201 Intermet preference actions (all pending before Judge Gross) include 12 adversary proceedings seeking recoveries of less than $11,725. The response available to each of these 12 defendants is to file a motion to dismiss based on improper venue. This sole “remedy” is the problem with the venue threshold. What practical benefit does the venue threshold provide if its benefits are only available to those who pay the legal fees necessary to assert the defense? Isn’t the small preference claim defendant in exactly the same position as if the venue defense did not exist at all: pay something to settle or pay a lawyer to file a motion to dismiss?

Applying the Venue Threshold to Claims of Multiple Debtors

The complaints in Intermet reflect substantial effort by the trustee to parse out the payments made by each of the 20 affiliated Intermet Debtors. Each complaint includes a transfer listing that attributes each transfer to a named Debtor on whose behalf the transfer was made. This is a welcome change from the form complaints that simply identify transfers has having been made by one or more of the “debtors”. The change is most likely attributable to the decision of Judge Brendan Linehan Shannon on July 14, 2010 in Charys Liquidating Trust v. Hades Advisors, LLC (In re Charys Holding Company, Inc.), 2010 WL 2788152 (Bkrtcy.D.Del.). See “SemCrude 356 Bankruptcy Preference Actions Filed Under Stricter Pleading Standard of In Re Charys“.

The precision in the Intermet pleading highlights the importance of the identification of the debtor making each transfer. In a few instances, the amount of transfers by one Debtor is less than the venue threshold while the aggregated amounts of transfers by all the Debtors exceeds the venue threshold. This leads to the obvious question: “Can dollar amounts made by multiple Debtors be aggregated to meet the venue threshold for bankruptcy preference claims?”

Although open to debate, we believe that the answer to this question should be “no”. The venue threshold should be applied on a debtor by debtor basis so long as there has been no substantive consolidation of the associated bankruptcy cases.

Where one debtor’s claims exceed and another debtor’s claims are less than the applicable dollar claim threshold, the analysis becomes one of cost to benefit. Simply, is it worth the cost to file a motion to dismiss as to the debtor whose claim is below the venue threshold when the motion will leave in place the claims by one or more other debtors?

The Lessons of an Economic Analysis of the Intermet Bankruptcy Preference Claims

It can be asserted (and we have heard it asserted repeatedly in representing small claim clients) that, once the decision is made to pursue preference claims, the trustee should seek recovery of preference claims in a fair and uniform fashion. Truthfully, fairness and uniformity do not drive the pursuit of small preference claims… economics do. The pursuit of small preference claims is a “profitable” proposition for the preference claimant and, perhaps more importantly, the timing of collection of small claim settlements is quick and early. Until this economic truth changes, small preference claims will continue to dominate the spectrum of preference claims.

_______________________

[fn1]In an indication that the list of preference defendants may not have been closely scrutinized, of these 204 complaints, 3 actions were dismissed two days later. Two of these dismissed claims had apparently been brought based on pre-bankruptcy retainer payments later approved by the Bankruptcy Court. A complaint against Kurtzman Carson Consultants LLC, the court approved claims agent for the Intermet bankruptcy, was dismissed on August 13, 2010. A complaint against Broadpoint Capital, the appointed financial advisor to the Debtors approved by the Bankruptcy Court on October 1, 2008, was also dismissed on August 13, 2010.